Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

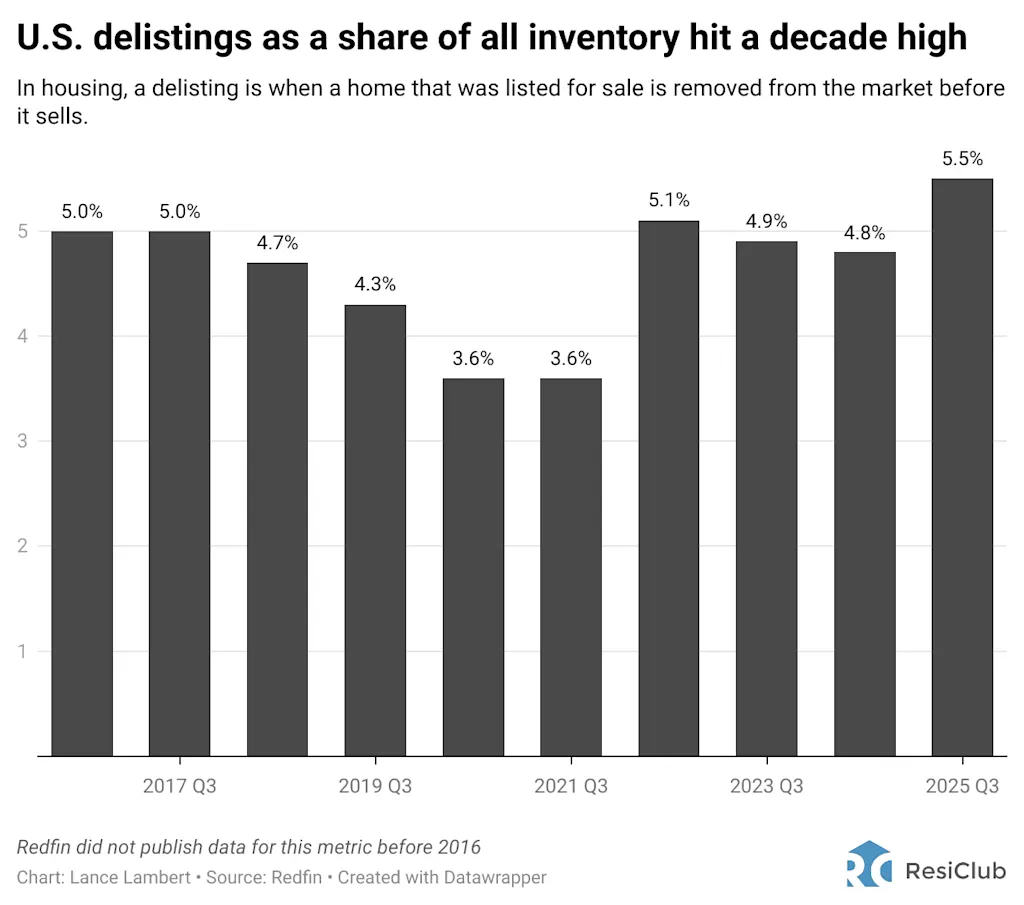

While national active inventory is still up year-over-year, the pace of growth has slowed since summer as some home sellers have thrown in the towel and delisted their properties. Indeed, according to Redfin, U.S. delistings as a share of inventory recently ticked up to 5.5%—a decade-high reading for this time of year.

Looking ahead, in markets seeing the biggest jumps in delistings right now, many of those listings will likely return to the resale market in spring 2026—or test out the rental market. Without a corresponding increase in housing demand, that could lead to a faster-than-expected acceleration in inventory growth.

“More sellers are giving up because their homes have been sitting on the market for a long time, and they don’t want to or can’t afford to settle on accepting a low price,” says Asad Khan, a senior economist at Redfin. “Many homes have a sticker price higher than buyers are willing to pay, but many sellers are unwilling to negotiate. When tens of thousands of homeowners pull their homes off the market rather than accept a low offer, it effectively reduces the supply of homes that are actually available for buyers.”

Of course, there’s wide regional variation in delistings. Weaker and softer housing markets in places like Texas and Florida are currently seeing a higher share of delistings. Meanwhile, tighter housing markets in the Midwest are seeing a lower delisting rate.

“Many homeowners who bought during the pandemic demand frenzy still expect sky-high prices,” says Khan. “They remember a seller’s market, so they’re hesitant to yield to buyers who want to negotiate the price down and/or ask for concessions. Recent buyers are also more likely to be testing the market; maybe they would sell and move up to a bigger home in a more desirable neighborhood if they get the price they want, but otherwise they’d stay put. Longtime owners, though, are more motivated to sell–they’re often downsizing or relocating for retirement.”

The housing markets with the highest level of delistings are also the same places with the most “stale” inventory—homes that have been on the market for over 60 days.

“Roughly one in five homes that were delisted over the summer were re-listed within three months: 20% of homes that were pulled off the market in July were subsequently re-listed, as were 18% of homes that were pulled in June,” writes Redfin. “We’re including this metric because delisting is sometimes used as a selling strategy; some sellers take their homes off the market and subsequently relist at a lower price to avoid house hunters seeing a ‘price drop’ on their listing, and to reset the number of days their home has been on the market.”

“Note that we’re looking at delistings over the summer rather than September to ensure that enough time has passed to determine whether a home was re-listed,” Redfin adds. “Of the homes that were delisted in July then put back on the market, 31.6% of them have sold.”