Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

When I recently reached out to Moody’s Analytics chief economist Mark Zandi for his updated home price forecast, he said his long-term outlook for the U.S. housing market remains largely unchanged: he expects a prolonged period of stagnation as affordability gradually improves.

Following the historic run-up in prices during the Pandemic Housing Boom and the subsequent mortgage rate shock, Zandi believes resale activity/existing home sales will likely stay frozen for several more years.

“Affordability has to be restored for housing to regain its mojo,” Zandi told ResiClub. “Flat home prices [adjusted for inflation] is the healthiest path forward—it’s the only way for incomes to catch up.”

Zandi expects nominal national home prices to move sideways over the next 12 to 24 months, with local variation: markets in the South and West, where building has been stronger, seeing some modest declines, while tight-inventory markets in the Northeast and Midwest remain more stable.

“The worst of the pain in the housing market might be now and in the next six to nine months. After that, things will begin to feel a little better—but not good,” Zandi said. “The housing market will heal . . . but it’s going to take time—and a lot of patience.”

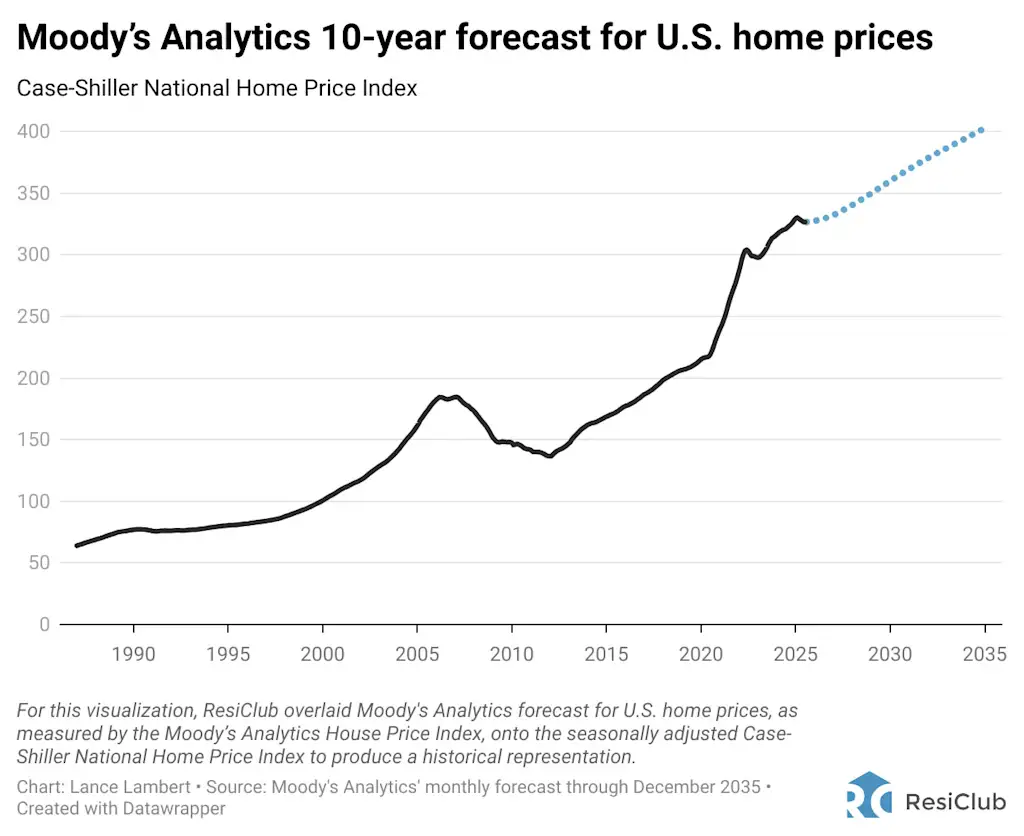

Over the next decade, Zandi projects U.S. home prices will rise roughly in line with inflation, meaning no “real” [adjusted for inflation] house price gains for around 10 years.

While Zandi’s team at Moody’s Analytics expects U.S. home prices not to rise on a “real” (i.e., inflation-adjusted) basis, the firm is forecasting that nominal U.S. home prices will increase +23.5% between December 2025 and December 2035.

(Note: Real home prices are adjusted for inflation, and nominal home prices are not adjusted for inflation. All the charts below are forecasts for nominal home prices.)

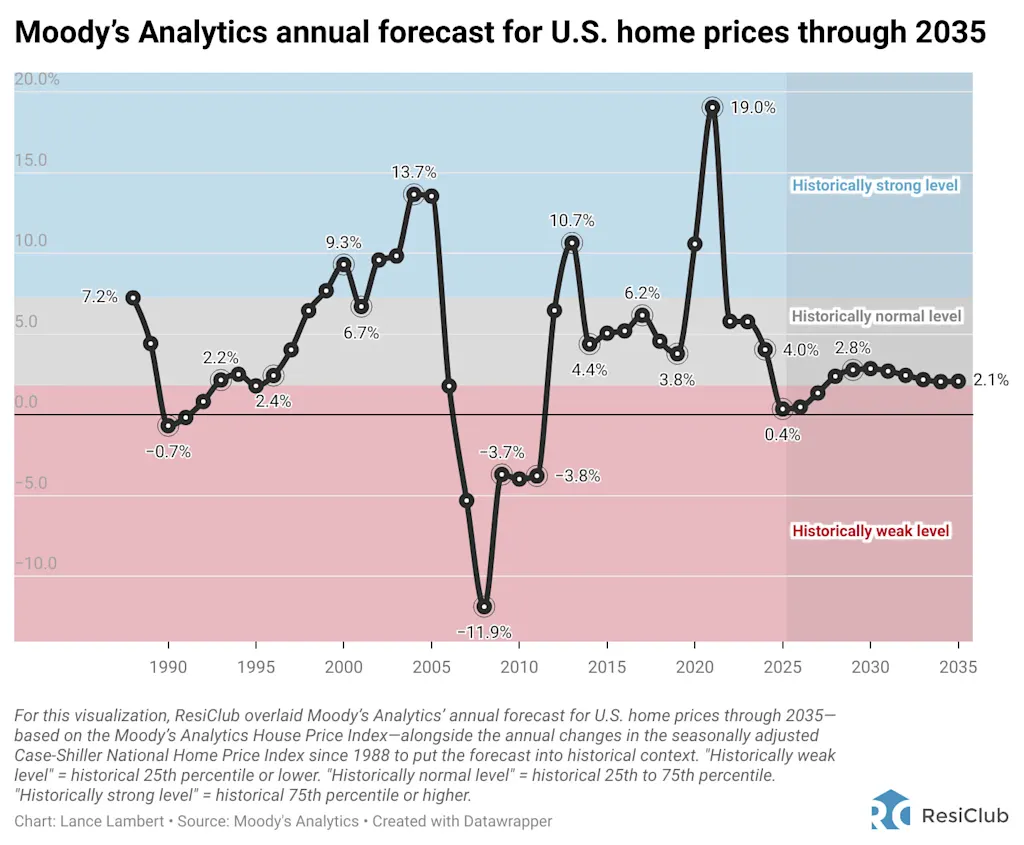

In the chart above, you can see where Moody’s latest forecasts would take U.S. home prices by the end of 2035—and in the chart below, how the forecasted annual gains compare to the historical performance of the asset class.

Moody’s forecast for annual home price changes:

- 2026 —> +0.48%

- 2027 —> +1.35%

- 2028 —> +2.39%

- 2029 —> +2.78%

- 2030 —> +2.86%

- 2031 —> +2.71%

- 2032 —> +2.44%

- 2033 —> +2.18%

- 2034 —> +2.05%

- 2035 —> +2.08%

Outside of affordability—the primary headwind Zandi believes is restraining “real” home prices and the broader housing market—he also highlighted additional challenges: a restrictive immigration environment that could limit the future construction labor force, particularly in the South and West, and elevated long-term Treasury yields connected to long-term fiscal risks.

He said the latter could keep mortgage rates closer to 6.0% than 5.5%—which had been his previous long-term outlook for the average 30-year fixed mortgage rate—for the foreseeable future.

How does Moody’s forecast vary by market? Check out the interactive below.

Financial forecasts looking out even one year often struggle to get it right—let alone those stretching out a full decade. So with any forecast like this, it’s best to approach it with some skepticism, or at least avoid treating it as a certain destiny.

Whether or not the exact numbers play out, Moody’s broader message is clear: The firm doesn’t expect a 2008-style housing crash or another explosive housing boom in the coming years. Instead, it anticipates the housing market will continue to gradually recalibrate following the historic Pandemic Housing Boom.