Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

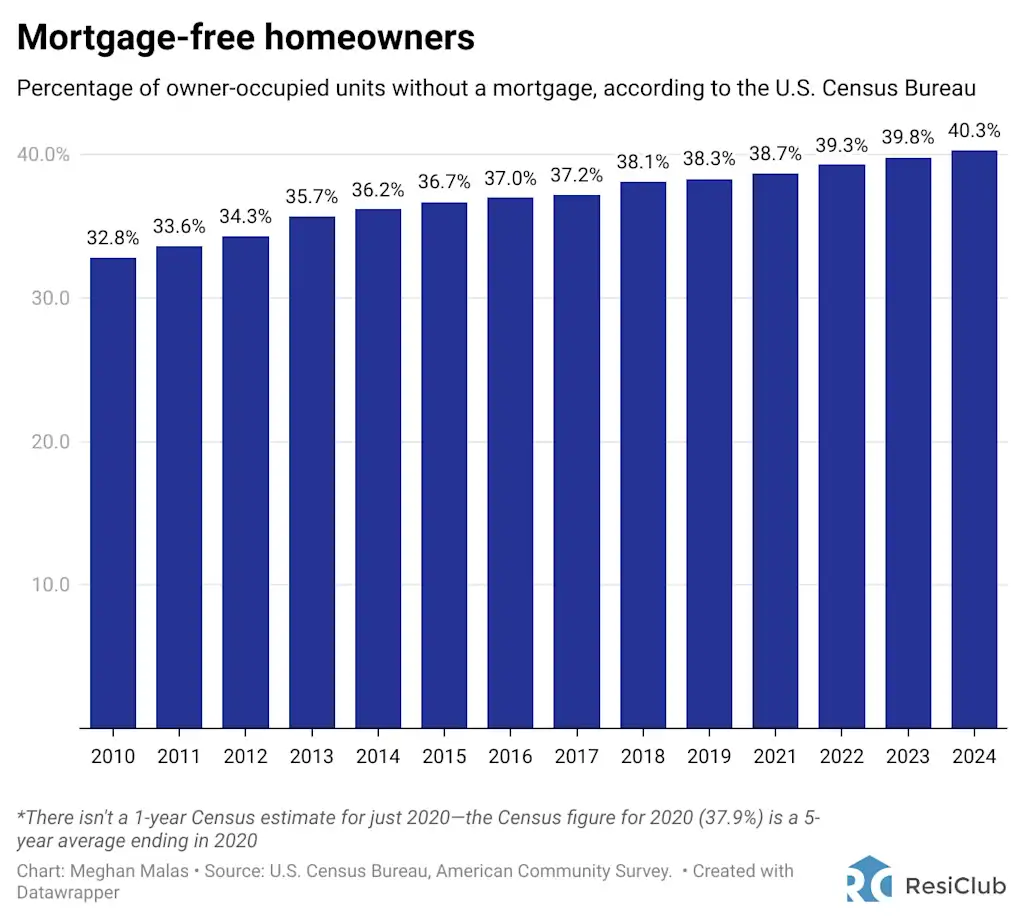

According to ResiClub’s analysis of the U.S. Census Bureau’s new annual data, 40.3% of U.S. owner-occupied housing units are now mortgage-free, marking a new high for this data series. That’s up from 39.8% in 2023.

The portion of homeowners with no mortgage has ticked up almost every year since 2010—when it was 32.8%.

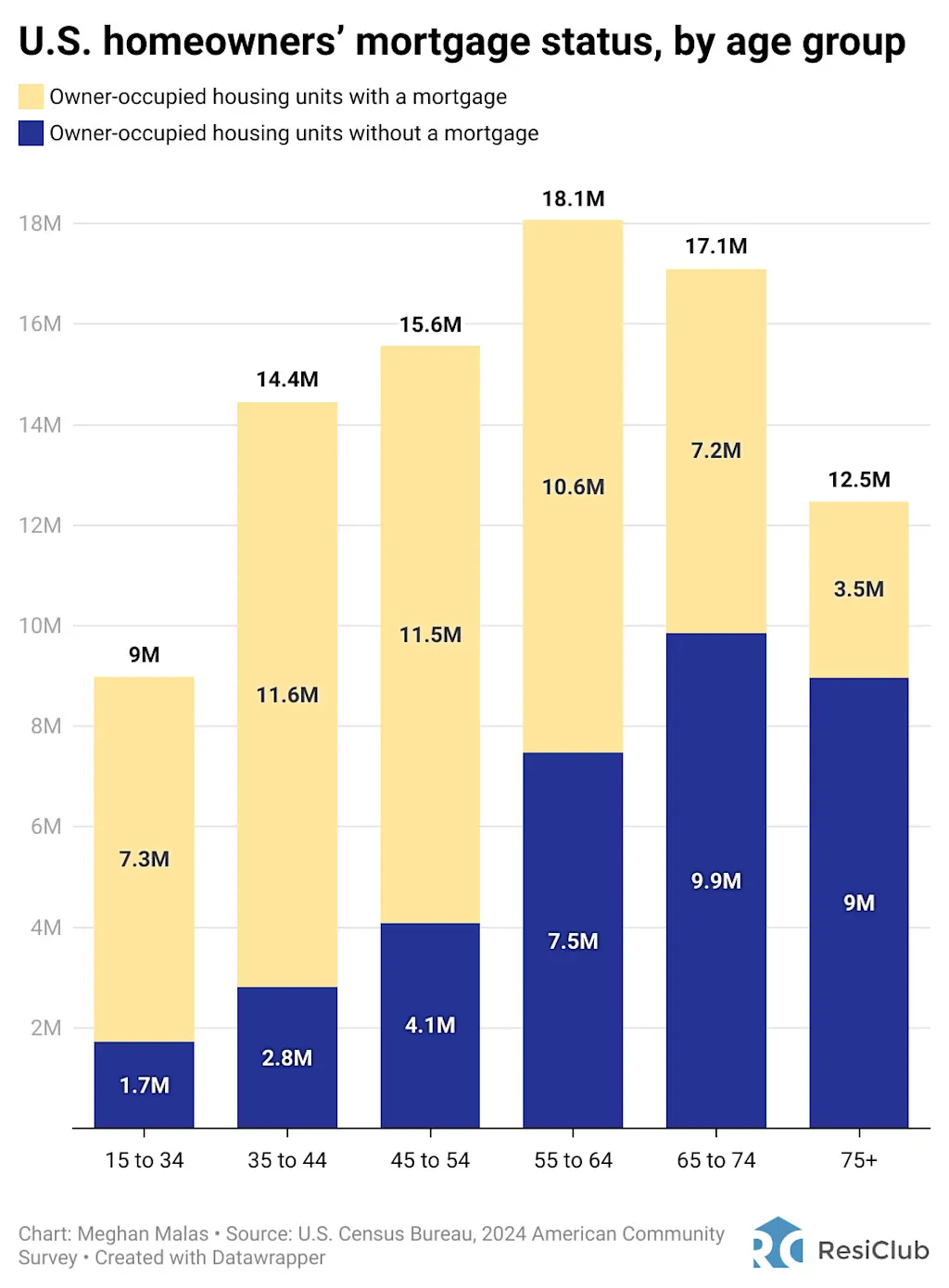

A key factor driving the rise in mortgage-free homeownership is demographics. Older homeowners are more likely to be mortgage-free, and as Americans live longer and the massive baby boomer generation ages into their senior years, the U.S. population has skewed older—pushing up the share of homeowners without mortgages.

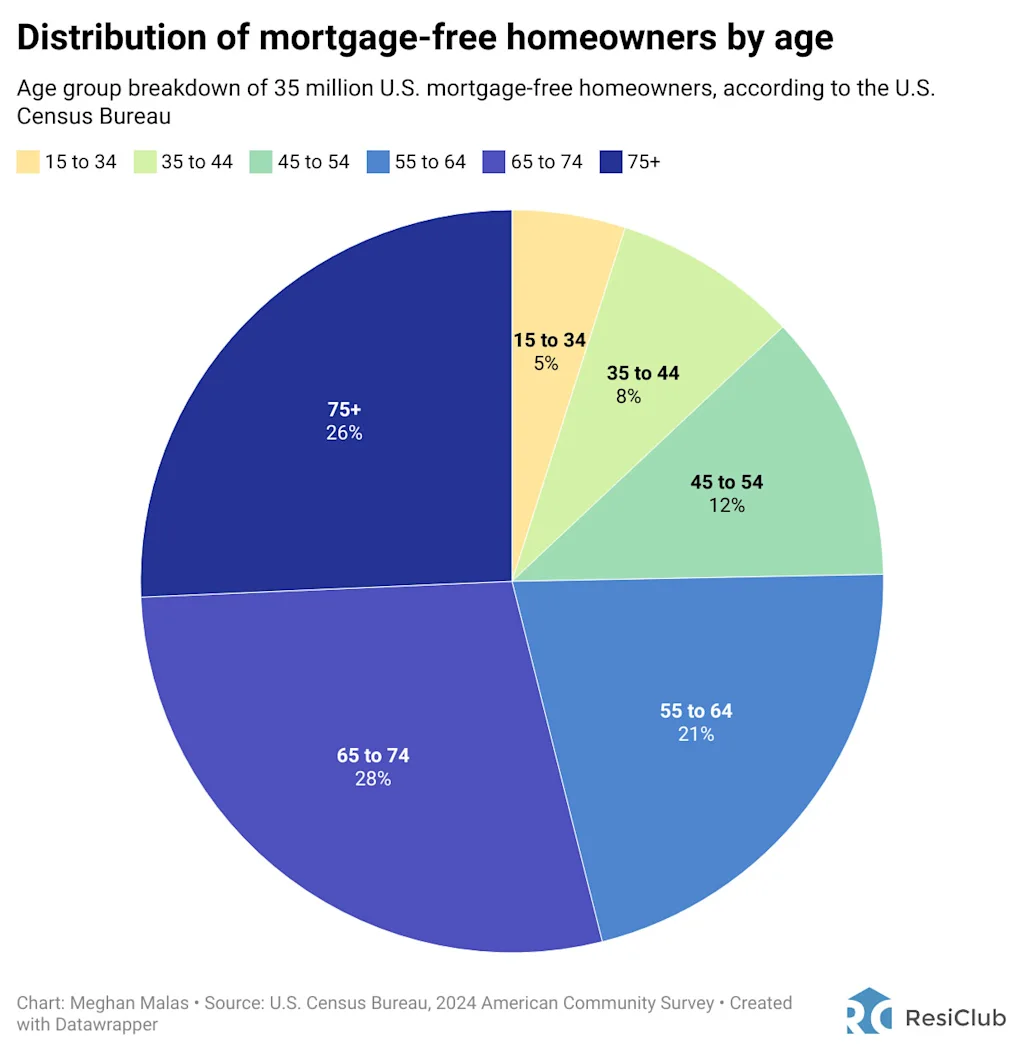

According to ResiClub’s analysis, 54% of the 35 million U.S. homeowners who are mortgage-free are 65 years old or older.

People aged 65 and older make up more than a third (34.1%) of current U.S. homeowners. Among those 65 and older, 64% own their primary homes free and clear.

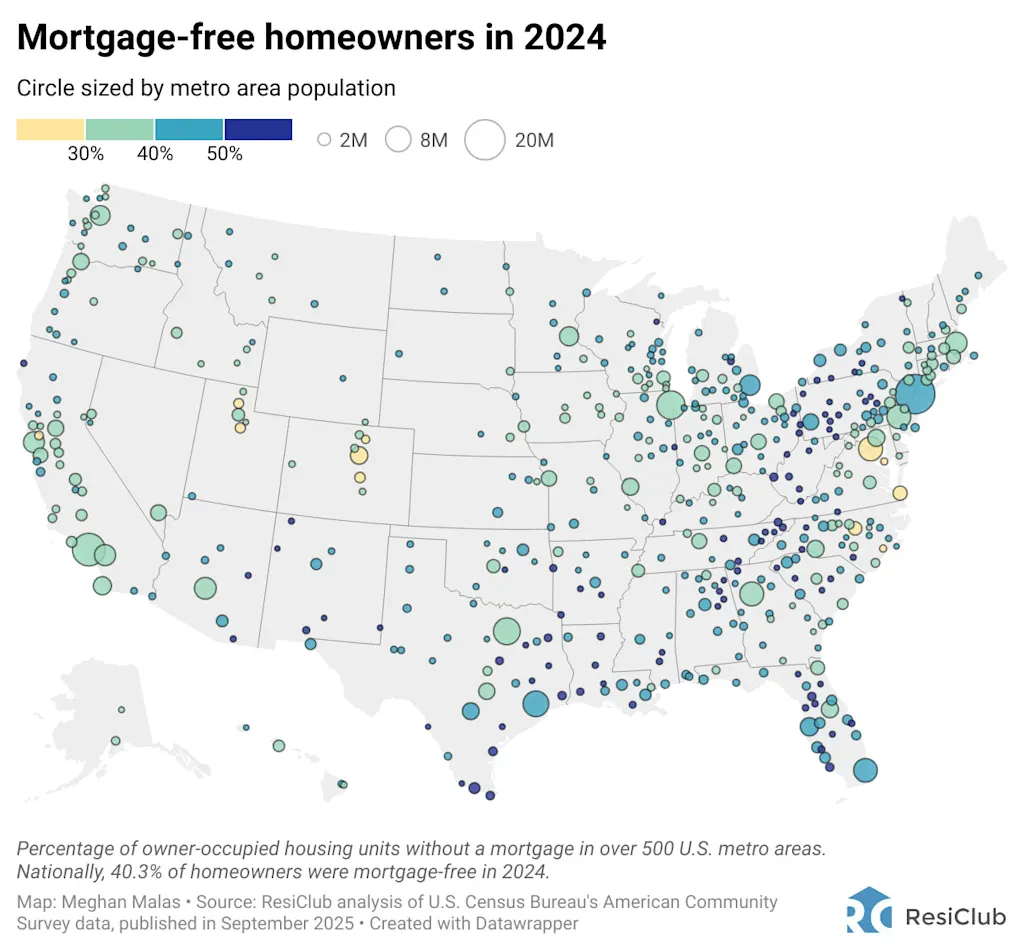

Across the country, mortgage-free status varies A LOT.

Regions with lower home values and areas with a higher proportion of older populations tend to have a slightly higher percentage of homeowners without mortgages.

Among the 200 largest U.S. metros by population, these 5 have the HIGHEST percentage of mortgage-free homeowners:

- 61.8% —> McAllen, TX

- 57.8% —> Brownsville, TX

- 57.1% —> Beaumont, TX

- 56.2% —> Kingsport, TN

- 55.8% —> Longview, TX

Among the 200 largest U.S. metros by population, these 5 have the LOWEST percentage of mortgage-free homeowners:

- 26.4% —> Washington, DC

- 27.0% —> Provo, UT

- 27.1% —> Denver, CO

- 27.2% —> Greeley, CO

- 28.8% —> Ogden, UT

Click here to view an interactive version of the map below

Mortgage-free homeownership has reached a new high. Demographics—particularly the aging of baby boomers—is a key force behind this trend.

In the years ahead, ResiClub expects more equity products (such as reverse mortgages) to emerge and expand, as some older mortgage-free homeowners look to tap into the equity they’ve built without selling their homes.